This issue typically arises due to issues with the email address associated with your merchant account as specified in your button code. To fix this problem, you need to:

- Ensure that the email address linked to your merchant account ID is verified and confirmed on your PayPal account.

- Opt for a secure merchant account ID instead of an email address.

Note: For safeguarding your PayPal login, consider using the secure merchant account ID instead of your PayPal account’s email address while generating a PayPal payment button.

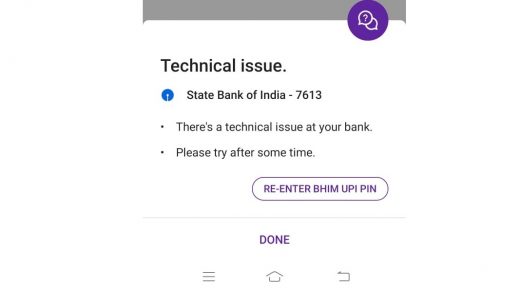

Why has my Paypal Payment Not been Received?

Once you’ve initiated the verification process for your bank account via your PayPal account, it typically takes about 2 to 3 business days for the transaction amounts to reflect in your bank account.

Similarly, if you have made two withdrawals to your bank account, these transactions should also be processed by your bank within the same 2 to 3 working days.

It’s important to note that even if your PayPal account displays the transaction as completed, this indicates that the funds have left the PayPal system.

The subsequent duration involves the processing of funds by your bank and their eventual crediting to your bank balance.

In the event that the funds have not yet appeared in your bank account, you should try reaching out to their customer services directly.

If the elapsed time is more than 10 working days and the issue persists, PayPal can initiate a trace on the funds to assist you further.

What is PayPal?

PayPal works as a digital payment platform that allows both individuals and businesses to securely send and receive money through either a mobile app or a website.

On a daily basis, PayPal manages approximately 41 million transactions, which marks a 20.58% increase compared to 2019, when around 34 million transactions were handled daily.

When connected to your bank account, debit card, or credit card, PayPal can facilitate online purchases.

It can be accessed via the web, mobile app, or even in person, acting as an intermediary to safeguard your bank information.

Who Uses PayPal?

Everyone. People across the globe use PayPal, boasting a user base of over 200 million individuals and 29 million merchant accounts.

Its presence in the market spans several decades, and it initially rose to prominence as the preferred digital payment method on eBay.

Over time, PayPal’s influence has extended to encompass a diverse range of businesses and individuals.

Its accessibility is notable, as it offers a simple entry point, unlike traditional bank accounts, enabling anyone to register and utilize the platform swiftly.

How PayPal Works?

PayPal operates as a mediator between individuals and banks. Users link their bank accounts or credit/debit cards to the PayPal system, allowing them to choose which account to use when making online payments.

Rather than directly involving the bank, PayPal handles all transaction processing.

Received funds are held within the PayPal account, available for online purchases, in-store transactions (via a PayPal card), or transfers to a bank account.

These transfers can take a few days or be expedited for a fee. You can also add funds to your PayPal balance using a bank account or linked card.

For individuals, PayPal offers straightforward services like money transfers, debit/credit card usage, e-checks, and check cashing.

Merchants can access a range of competitive services without lengthy contracts, such as PayPal Shipping, Invoicing, Working Capital, and even Loans.

Creating a PayPal account is free, though there are associated charges for using the service. The fee structure varies depending on whether you’re an individual sending money to friends or a business handling payments.

If you’re engaged in invoicing and receiving payments for goods or services, expect PayPal to issue 1099 tax forms.

PayPal is accessible through websites, mobile apps, integrations, or programmatic interfaces. It provides comprehensive tools and services for point-of-sale (POS), e-commerce, and subscription-based transactions.

The platform prioritizes user protection by offering features like seller protection, purchase resolution, and robust digital security measures.

Understanding Different PayPal Payment Statuses

Here are several explanations that will help you know the status of your PayPal payments:

- Pending: PayPal is currently reviewing the transaction. Your payment will be sent to the recipient once PayPal confirms the validity of your payment source. If you’ve used an eCheque, it typically takes around 7 working days to clear, and during this time, the transaction will appear as ‘Pending’ on your Summary page.

- On hold: Funds are temporarily held either due to a complaint you filed or for transaction review purposes. You can expect an email from PayPal providing further details about the particular transaction.

- Held: Your payment is being reviewed, resulting in a temporary hold. Please refer to the Resolution Centre for more comprehensive information.

- Temporary hold: During the authorization process, funds from your account are momentarily held. The recipient cannot access or withdraw this money until the authorization process is finalized.

- Refunded: The recipient has returned your payment. If your payment was made through a credit card, the refunded amount will be credited back to your credit card. The refund might take up to 30 days to reflect on your statement.

- Returned: Money has been returned to your account because the recipient did not claim your payment within the 30-day window. PayPal members can manually reverse unclaimed payments prior to the automatic 30-day reversal.

- Denied: The recipient did not accept your payment, leading to a refund credited back to your account. Review the transaction details to understand why the payment was denied, or contact the recipient for additional information.

- Unclaimed: Your payment has not been accepted or received by the recipient. Unclaimed transactions are automatically canceled after 30 days.

- Completed: The transaction was successful, and the recipient’s account has been credited with the funds.

Why Should I Use PayPal?

There are several reasons why you should opt for PayPal to make your transactions. Here are just a few of them:

1. Convenient and User-Friendly

PayPal has become the fifth most widely accepted payment option, following Visa, Mastercard, American Express, and Discover.

It is accessible at countless online stores. Have you ever faced a situation where you wanted to make an online purchase but didn’t have your credit card available?

With PayPal, you can conveniently use cards linked to your account, eliminating the need to enter your card details anew.

Making a payment through PayPal only requires you to remember (or securely store) your PayPal login credentials.

2. Enhanced Transaction Security

When you use your credit or debit card for online transactions, merchants sometimes gain access to your payment details.

PayPal offers an additional layer of security by ensuring that merchants never have access to your sensitive information.

Moreover, PayPal employs several security measures to safeguard accounts, including end-to-end data encryption, the option for two-factor authentication during account logins, and transaction confirmation emails.

Final Words

PayPal is one of the best money transfer platforms in the world. It has won its position due to its easy-to-use and intuitive user interface. Plus, the customer service is highly responsive.

In case you face any trouble while using the platform, be sure to contact them right away.

If you've any thoughts on What to Do if PayPal Payment is Completed but Not Received?, then feel free to drop in below comment box. Also, please subscribe to our DigitBin YouTube channel for videos tutorials. Cheers!