PayPal serves as a money transfer platform. Typically, sending money may be restricted due to inadequate funds or imposed limitations on the respective PayPal account.

If you’re curious about the message “We can’t process your payment right now, so please try again later. We’re sorry for the inconvenience” displayed by PayPal, the initial action is to verify if your account holds enough funds for the transaction.

This article will discuss common reasons why PayPal won’t let you transfer money and several ways to fix this error, We’re not able to complete this transaction at the moment, or We can’t complete this transaction right now.”

Causes of PayPal Money Transfer Fail Error

The primary causes of this specific error, as outlined by PayPal technical support, include:

- Without a PayPal Account: If a customer doesn’t have a PayPal account, their credit card is subjected to a lifetime transaction cap of approximately $4000 when using the PayPal Guest Checkout Experience. This cap encompasses all payments ever conducted through this credit card via PayPal Guest Checkout.

Even if the total hasn’t reached $4000, they’re limited to using the card 15 times as a guest. If PayPal flags the card, the user will need to create a PayPal account (with a username and password) for added security. Either way, the attendee or buyer must sign up for a PayPal account to utilize that credit card.

- Existing PayPal Account: If the customer already has a PayPal account and the credit card or email address is recognized, they must log in to PayPal first due to security requirements.

Additional factors contributing to this issue are:

- Account Restrictions

- Transaction surpasses the weekly limit

- Ineligibility of the credit or debit card

- Inaccurate bank account details

- Invalid email address

PayPal enforces these limitations for security purposes and are directly related to the buyer’s credit card account.

The only resolution is to suggest to them the creation of a PayPal account using the respective credit card (if not already done), or the use of their existing PayPal account, if available, to finalize the transaction.

Tips to Resolve PayPal Money Transfer Failed

Here are steps to address the issue of PayPal restricting money transfers from various funding sources:

1. PayPal Won’t Let You Send Money From Your Balance

If you’re facing this issue, here are several ways to fix it:

- Ensure your PayPal balance holds sufficient funds. If not, either add funds to your balance or consider using alternate funding methods.

- If you possess adequate funds but encounter difficulty sending money, verify whether PayPal has imposed limitations on your account. Refer back to earlier instructions to resolve any such restrictions. PayPal might block your money transfer due to detecting suspicious activities associated with your account. Address these concerns with PayPal before attempting to initiate a transfer.

- Consider that the recipient’s account could be restricted, hindering their ability to receive payments.

If these steps fail to resolve the issue, reach out to the PayPal Help Center for assistance. They can assist you in diagnosing the problem and offer further guidance to resolve it.

2. PayPal Won’t Let You Send Money From Your Credit Card

If sending money on PayPal is becoming difficult, several underlying reasons could exist. One possibility is an account limitation imposed by PayPal, requiring you to undergo a security verification to confirm your identity.

Another factor could be unsuccessful attempts to use Instant Transfer, possibly due to compatibility issues with your debit card. Additionally, suspicions of unusual account activity might be hindering your ability to send money via your card.

Insufficient funds in your PayPal account and potential transaction declines from your card issuer are also potential hindrances. If all efforts to send money prove fruitless, reaching out to the PayPal Help Center for guidance and assistance is advisable. They can help solve the issue and provide further steps for resolution.

3. PayPal is Not Allowing You to Send Money From Your Bank Account

There are several potential causes for PayPal preventing you from transferring money via a bank transaction, apart from the reasons mentioned for other payment methods.

This might arise from insufficient funds in your bank account, limitations imposed on your PayPal account necessitating identity verification, or your bank account’s incapacity to process Instant Transfer, especially if you’re attempting to use this service.

Occasionally, the root of the issue could lie with your bank, requiring you to reach out to them for further insights. Moreover, restrictions on the recipient’s account could be a factor, particularly if the recipient hasn’t completed PayPal’s security validation or resides in a country where PayPal doesn’t permit incoming funds.

Furthermore, PayPal might retain a portion of your balance as a reserve. This reserved amount serves as a safeguard, utilized by PayPal when they encounter challenges in collecting overdue balances resulting from chargebacks, claims, debit transactions with insufficient funds, or fees.

If grappling with resolving the predicament of being unable to transfer funds to your bank through PayPal, or encountering the error “PayPal you can’t send money at the moment,” it’s advisable to contact customer service.

The contact number is available within your PayPal account under the “contact us” section, enabling you to inquire about the prevention of transferring money and address the issue.

How to Solve the ‘Insufficient Funds’ Problem When Transferring Money via PayPal?

Many individuals often find themselves questioning, “Why is PayPal preventing me from transferring funds?”, “Why is PayPal refusing my money transfer?” or “Why am I unable to move money from PayPal?” There are numerous queries surrounding PayPal’s restrictions on money transfers.

If you encounter the “Insufficient Funds” error while attempting a PayPal money transfer, it indicates that the funds in your PayPal balance or linked bank account are insufficient to complete the transaction, resulting in PayPal’s inability to process the money transfer.

To address this issue, here’s what to do:

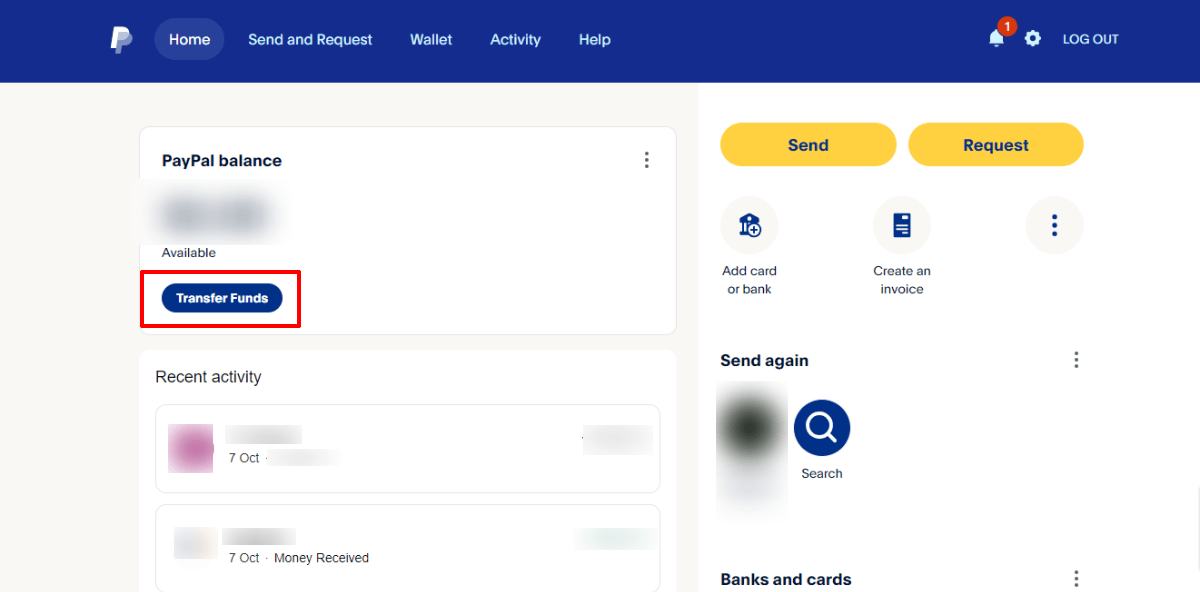

- Ensure that your PayPal balance holds enough funds to cover the intended amount for the transfer. You can verify your balance by logging into your PayPal account.

- If your PayPal balance is inadequate, click on the “Add Funds” button to link a bank account, credit card, or debit card and add funds accordingly.

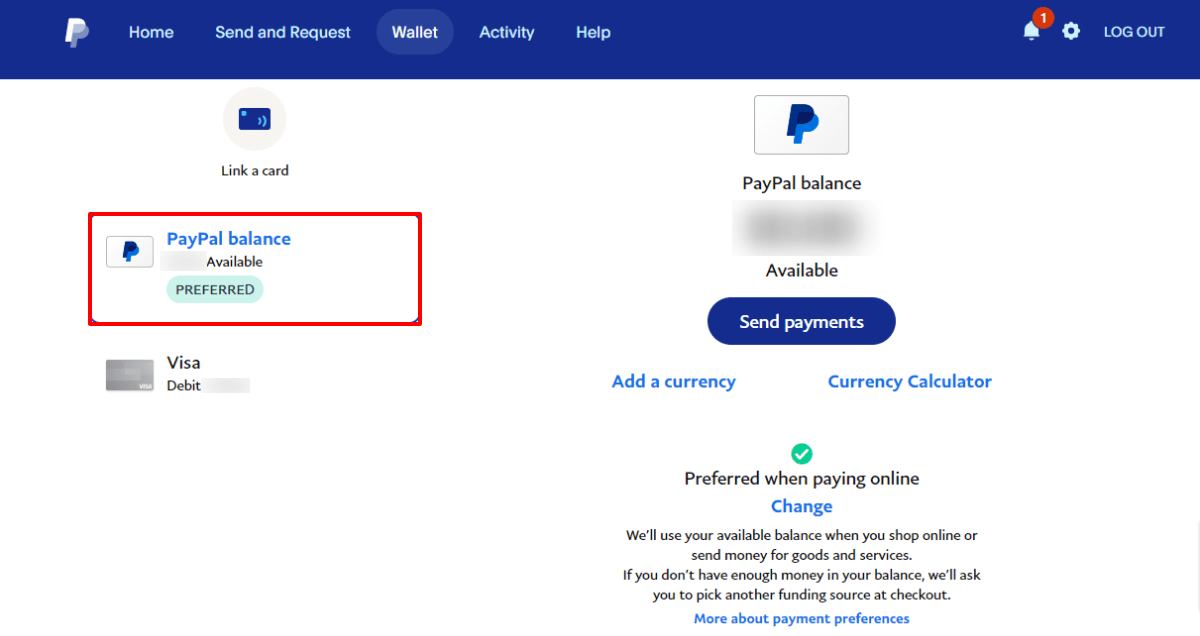

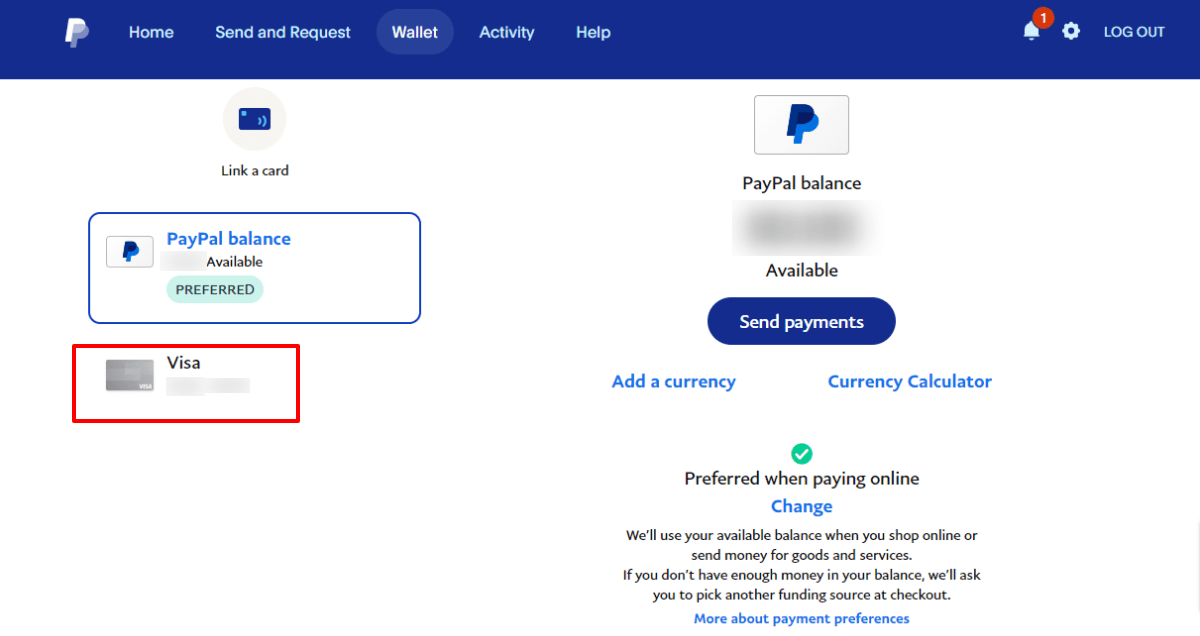

- If you’ve linked a bank account or credit card to your PayPal account, ensure that there are sufficient funds available in those accounts. PayPal may sometimes lack the necessary funds to cover the transaction, even if your PayPal balance is sufficient.

- Consider using an alternative payment method if you initially attempted to use a credit card or bank account. For instance, you could switch from a credit card to a bank account.

- If the preceding steps don’t resolve the issue, reach out to PayPal customer support for assistance, informing them of the difficulty in transferring funds to the bank. You can find the “Help & Contact” tab within your PayPal account.

- Double-check and ensure that the recipient’s email address and name are accurate to prevent transaction failures arising from typographical errors or incorrect information.

- If you’ve recently added funds or linked a new bank account or credit card, and PayPal isn’t allowing you to add money, be patient as the funds may take some time to clear. Wait for the payment to clear before attempting the transaction once again.

Frequently Asked Questions

Why Did My Bank Transfer Through PayPal Not Go Through?

If the funds haven’t shown up in your bank account, contacting customer service is advisable. Once 10 working days have passed, we can assist in initiating a trace on the funds to ensure they reach you.

What Do I Do if I Face an Error When Transferring Funds Online?

If you face an error during an online fund transfer, first you need to calm down. Errors can stem from various factors. Start by verifying your internet connection and ensuring you’re using a compatible browser or app. Double-confirm the recipient’s information to rule out any inaccuracies. If the issue persists, reaching out to your bank or financial institution’s customer support is recommended. They can provide insights into the specific problem and guide you through the necessary steps to address it.

Is It Possible to Receive Funds Through PayPal Without Connecting a Bank Account?

For account functionality, PayPal securely links to a bank account or a credit card. While you can accumulate funds in your PayPal account without needing a bank account or credit card, linking a bank account becomes necessary when sending money to family and friends or when attempting to withdraw funds.

Why Was My Online Fund Transfer Declined, Even With Funds in My Account?

While having sufficient funds is a prerequisite for a successful transfer, there could be additional factors leading to a decline. Your bank may have implemented security protocols flagging the transaction as potentially fraudulent. Moreover, account restrictions could also deter specific types of transactions. To address this, contact your bank’s customer support for insights into the decline and guidance on resolving the issue.

What’s the Reason Behind Paypal’s 3-Day Money Transfer Duration?

Typically, the transfer of funds from your linked bank account to your PayPal balance takes around 3-5 business days. This process involves debiting the money from your bank account, followed by verification and processing of the transaction through the Federal Reserve’s ACH (Automated Clearing House) before the funds are released to PayPal.

What Do I Do if I Receive Confirmation of an Online Fund Transfer, but the Recipient Insists They Haven’t Received the Funds?

In cases where a confirmed transfer hasn’t reached the intended recipient, prompt action is vital. Begin by reviewing the transaction details in your account to ensure there were no errors in the recipient’s information. If everything seems accurate, request the recipient to double-check their account details as well. Occasionally, delays may arise due to varying processing times among financial institutions. If the issue persists, reach out to your bank or payment service provider, enabling them to initiate an investigation to trace the funds and furnish you with updates on the transfer’s progress.

The Bottom Line

In a nutshell, this article has shared insights into the common problems people face while using PayPal to send money.

Figuring out why these errors happen and learning how to fix them is important. We’ve made it easier by giving simple and clear steps to solve these issues.

We hope this guide has been helpful and you’ll now be able to use PayPal without any hiccups. Remember, sending money through PayPal should be a breeze once you know how to deal with these common problems!

If you've any thoughts on How to Fix PayPal Money Transfer Fail Error?, then feel free to drop in below comment box. Also, please subscribe to our DigitBin YouTube channel for videos tutorials. Cheers!